Why Companies Worldwide Set Up Their Headquarters in Singapore

3 min Read

More and more entrepreneurs, corporations, and ventures of all sizes worldwide are using Singapore as their regional or global headquarters. The city-state is consistently recognized as a global business hub – thanks to its thriving infrastructure, political stability, pro-business environment, competitive workforce, and respect for intellectual property rights.

Business owners will find it advantageous to locate their headquarters in Singapore. Strong trade and investment make Singapore the most competitive Asian country and the most accessible place in the world to do business. This article provides a comprehensive explanation of why companies worldwide set up their headquarters in Singapore.

Global & Regional Rankings

Singapore is consistently ranked highly in international surveys. Some of the global and regional rankings that Singapore has received include:

- Last year, Singapore ranked as the first best business environment in the Asia Pacific and the world: Business Environment Rankings (BER) 2020 by The Economist Intelligence Unit.

- Singapore was ranked number one in achieving human capital (knowledge, skills, and health) globally: Human Capital Index 2020 by the World Bank.

- Singapore occupied the second position in the world for the easiest place to do business: Ease of Doing Business Index 2020 by the World Bank.

- According to the Index of Economic Freedom, Singapore’s economic freedom score is 89.7, making its economy the freest in the 2021 Index.

- The Transparency International’s Corruption Perceptions Index 2020 has ranked Singapore the third least corrupt country in the world out of 180 countries with a high score of 85.

- In the World Economic Forum’s 2019 Global Competitiveness Report, Singapore scored 85 points out of a possible 100, placing it above the US, Hong Kong, the Netherlands, and Switzerland in the top five.

- Singapore ranked first in Asia-Pacific for effective governance and enforcement of the rule of law: Rule of Law Index 2020 by the World Justice Project.

- Singapore ranked top in Asia-Pacific again for the seventh consecutive year in the Global Innovation Index (GII) 2020. The city-state has also maintained its eighth position in global rankings.

Why Companies Choose Singapore as Their Headquarters

Whether you are a non-resident individual, small and medium-sized company, or multinational, choosing Singapore as your headquarter will provide you with a launching pad to other developing countries in the region. Apart from this, you can benefit from various aspects that the country has, such as:

1. Ease of Incorporation

Compared to other business hubs, it is easier and faster to register a company in Singapore.

The requirements for entering the company are very straightforward, and the procedure for doing so is simple. In most cases, it will take less than a day to register a new company.

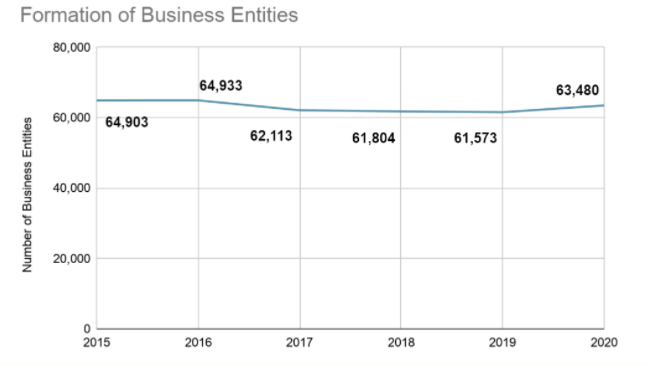

Each year, many local and foreign business entities are incorporated in Singapore. Private limited companies are the most preferred ones. Let’s look at the line chart below to see the recent trends in the formation of business entities in Singapore.

Data analyzed by Biz Atom

There was quite a moderation between 2016 and 2017 due to a slowdown in the economy. However, the number of business entities formed in Singapore remained healthy from 2017 to 2020. In fact, the number grew back by 3,26% last year despite the Covid-19 pandemic.

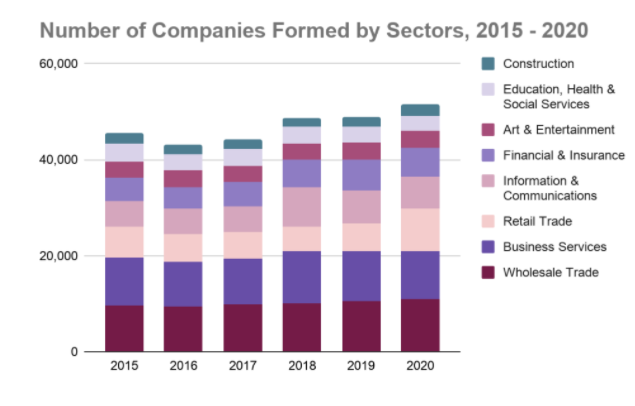

In terms of sectors, the wholesale trade, business services, and retail trade sectors were the main contributors to overall company formation throughout 2015 to 2020, with 4% growth on average over the years. Meanwhile, other sectors grew by around 2%.

The retail trade was the sector with the highest growth in the number of registered companies last year, mainly due to the rise of online retail platforms. In 2020 alone, the number of new companies in the retail trade sector grew by 54%.

Data analyzed by Biz Atom

For detailed information about how to incorporate a company in Singapore, you may refer to:

A Complete Guide on Company Registration in Singapore

2. Strong Economy

Singapore is a high-income country known for its outstanding finances and high levels of openness. Being one of the most competitive economies worldwide, Singapore is renowned for providing one of the most business-friendly environments globally.

Singapore’s GDP growth is currently mainly driven by exports and domestic demand. The country’s GDP fell from $372 billion in 2019 to $337 billion in 2020 due to the impact of the pandemic. However, it is expected to return to $362 billion and $379 billion in 2021 and 2022, respectively.

In terms of GDP per capita, Singapore is ranked 7th globally in 2021. Here is the current GDP per capita comparison of Singapore with other Asian countries:

| Country | GDP per Capita (Nominal) ($) |

| Singapore | 62,113 |

| Hong Kong | 47,990 |

| Japan | 40,733 |

| Korea | 32,305 |

| Taiwan | 28,889 |

| China | 11,956 |

| Malaysia | 11,378 |

| Thailand | 7,675 |

| Indonesia | 4,287 |

3. Strategic Location

Singapore is home to the world’s top players in all industries, partly due to its location in the heart of Southeast Asia and close to neighboring emerging markets. Moreover, some of the world’s most important economies (China, India, Malaysia, Australia) can be reached by plane in no time.

The port of Singapore is one of the busiest in the world and is classified as a major International Maritime Center. Singapore Changi Airport is a world-class airport serving approximately 60 million passengers annually and provides comfortable flights to nearly every major city in the world.

4. Attractive Tax System

Singapore has one of the most straightforward and most rational tax systems in the world. With a single-tier tax system, Singapore only collects taxes on company profits but does not impose taxes on dividends paid to shareholders. Likewise, Singapore does not tax capital gains and most types of foreign-sourced income.

Corporate Income Tax

Singapore’s main corporate tax rate is 17%. However, due to the abundance of tax incentives and tax breaks, the effective tax rate for most Singaporean companies is much lower. Personal tax rates range on a progressive scale from 0% to 22%. We have compared the latest corporate income tax rates in Singapore with several other countries in Asia:

| Country | Corporate Tax |

| Singapore | 17% |

| Malaysia |

24% (highest rate) 17% (lowest rate) |

| Indonesia | 22% |

| South Korea | 25% |

| Japan | 30.62% |

| Thailand | 20% |

| China | 25% |

| Taiwan | 20% |

| India | 35% |

Tax Reliefs

New companies in Singapore can take advantage of tax exemptions of up to $125,000 on their first $200,000 in revenue for their first three consecutive years of business. To be eligible for the tax exemption, your company must be incorporated in Singapore and have a maximum of 20 shareholders. In addition, one shareholder must be an individual who holds a minimum of 10% of the shares.

Companies that have not previously claimed the Tax Exemption for New Start-Up Companies can claim the Partial Tax Exemption. This allows an exemption of up to $102,500 on the first $200,000 of chargeable income.

For more information about Singapore’s tax exemptions, please refer to:

What are Tax Exemptions for Singapore Companies Like?

Other Tax Incentives

The Singapore government has introduced two specific schemes to encourage companies to use Singapore as their regional or global headquarters:

Regional Headquarters (RHQ) Award

Under the RHQ Award, eligible companies can enjoy a concession tax rate of 15% for five (3 + 2) years on additional qualifying foreign-sourced income instead of Singapore’s regular corporate tax rate of 17%. In other words, if the applicant company meets all the minimum requirements by the third year of the incentive period, it will enjoy a concession tax rate of 15% for an additional two years of qualifying income. This scheme applies to all companies with headquarters in Singapore.

International Headquarters (IHQ) Award

This tax incentive scheme is open to all entities that have established a company in Singapore to carry out their headquarter activities. More specifically, companies committed to exceeding the minimum requirements for the RHQ Award can enjoy lower concession tax rates ranging from 5% to 15% on additional income from eligible activities.

Corporate Income Tax Installment Plans

To ease the burden on business owners affected by Covid-19, the Inland Revenue Authority of Singapore (IRAS) offers longer corporate income tax payment plans. However, there are requirements that companies must meet to qualify for this waiver. You can find out such information in this article:

Corporate Income Tax Installment Plans for Singapore Companies in 2021

Avoidance of Double Taxation Agreements

Singapore has an extensive Double Taxation Agreement (DTA) avoidance network with more than 50 countries. DTAs are designed to ensure that economic transactions between Singapore and the treaty countries are not subject to double taxation. In addition, Singapore provides Unilateral Tax Credits (UTCs) for the case of countries that do not have DTAs. Thus, Singapore tax resident companies are most unlikely to face double taxation.

Read this related article for further information about DTA avoidance:

Singapore’s Double Tax Treaties Explained

100% Foreign Ownership

In Singapore, foreigners can own 100% of the shares of their Singapore legal companies. No local partners or shareholders are required. You can start a company with the type of capital structure you desire and distribute the holdings according to your investment needs. Also, there is no limit to the amount of capital you can bring from your home country to invest in your Singapore company.

Singapore has no restrictions on the repatriation of profits. No tax is levied on capital gains from the sale of a business. Likewise, no tax is levied on dividends paid to shareholders.

Furthermore, the city-state does not impose any restrictions on foreign currency movement into or out of the country. This cross-border friction-free movement of funds can give businesses extreme flexibility, in contrast to countries such as China and India, which impose considerable barriers to the free movement of foreign currencies.

Government Support for Businesses

The Singapore government has always been supportive of businesses by providing numerous avenues for financial support, from tax incentives to grants. For example, enterprise Singapore (ESG), a statutory board under the Ministry of Trade and Industry (MTI), provides various grants, loans and insurance, and tax incentives for Singapore startups and existing companies.

Recently, the Singapore government has also announced its 2021 national budget in which it allocated S$11 billion (US$8.3 billion) for the Covid-19 Resilience Package. In addition, it will expand existing schemes to help businesses and save jobs by subsidizing workers’ wages, providing access to working capital for businesses, and supporting targeted industries such as aviation.

Absence of Corruption

Singapore is again at the top of the least corrupt countries globally based on a global survey released annually. This success mainly comes from the vigilance and persistence of the Singapore society in preventing corruption as a nation. According to the Corrupt Practices Investigation Bureau (CPIB), the current situation in Singapore remains well-controlled, with reports of corruption on a downward trend, and public sector cases have remained low for years.

Conclusion

Singapore is one of the most developed countries that provide a very business-friendly environment for new entrepreneurs. Its healthy economy, strategic geographic location, attractive tax policies, and efficient government make it a perfect place to set up a new business and headquarter.

A series of joint policies by the government have made Singapore one of the most favorable destinations for foreign-owned companies. Its advantages include ease of doing business, strategic location, low taxes, and various grants and incentives from the government. For these reasons, thousands of local and foreign entrepreneurs make it a new home for their business every year.

Subscribe to Our Newsletter

Stay up-to-date with our useful guides on company incorporation, accounting & taxation and business management!

Subscribe to Our Newsletter

Stay up-to-date with our useful guides on company incorporation, accounting & taxation and business management!

Need advice on the best structure

for your business

Biz Atom helps entrepreneurs and international business make the right choice when setting up in Singapore.